Welcome to the fascinating world of forex trading, where currency exchange reigns supreme, and opportunity meets strategy. Let’s start an exploratory journey into this global financial phenomenon.

Understanding the Forex Market

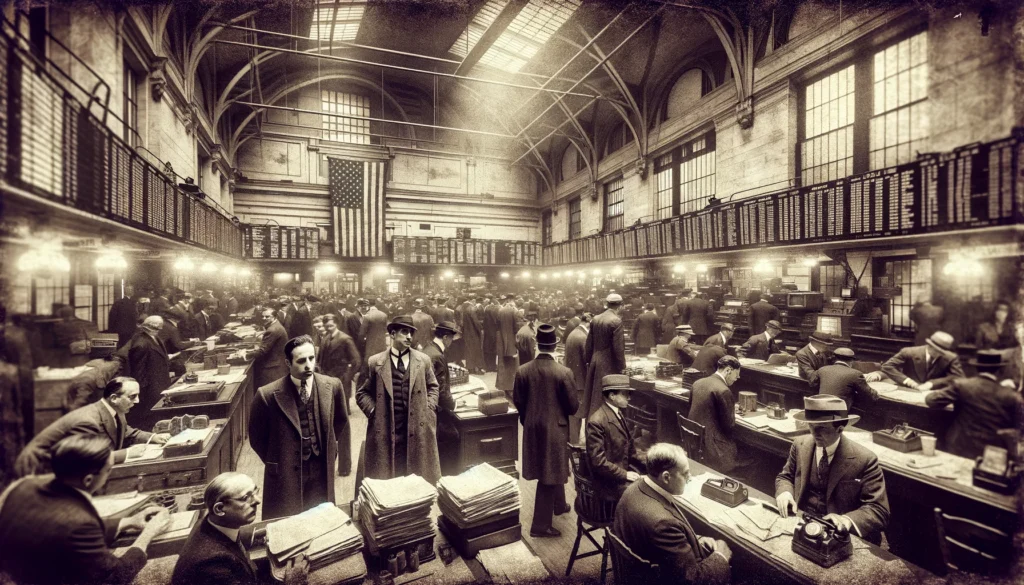

Forex, the shorthand for foreign exchange, is where currencies play a game of musical chairs, and traders strive to profit from their moves. Imagine a bustling marketplace that never sleeps, where traders from Tokyo to New York exchange currencies at all hours. It’s a realm where the past meets the present; its modern form was shaped significantly after the Bretton Woods agreement dissolved in the 1970s, allowing currencies to freely float and dance to the tune of the market.

The Heart of Forex Trading

At the core of forex are the major financial hubs—New York, London, Tokyo, and Sydney. They are the pillars holding up the sky of this 24-hour market. It’s a decentralized stage where the sun never sets, and traders find solace in the endless rhythm of buying and selling.

Diving into Currency Pairs

Diving into forex means getting to know the currency pairs closely. The market buzzes with the energy of pairs like the Euro and Dollar, nicknamed ‘Fiber’, or the Dollar and Yen, known as ‘Ninja’. These aren’t just abstract concepts; they’re the lifeblood of the market, flowing through the veins of the global economy.

The Language of Forex

Forex speaks its own language, where terms like ‘spread’, ‘leverage’, and ‘margin’ are the alphabet. They define the nuances of trading, from the difference in buy and sell prices to the ability to control large trades with a relatively small investment. ‘Going long’ or ‘going short’ are your strategies in play, dictating whether you’re betting on the rise or fall of currencies. Navigating through forex is similar to mastering a new dialect, one that’s both complex, detailed, and immensely rewarding.

Strategizing Your Trades

Forex trading strategies are as varied as the traders themselves. Some prefer the rapid-fire approach of ‘scalping’, seeking small profits swiftly. Others find convenience in ‘day trading’, wrapping up their trades before the day’s close. Then there are the ‘swing traders’, who ride the waves for a few days, and the ‘investors’, who play the long game. Each style is unique, and finding your rhythm is key to harmonizing with the market’s ebb and flow.

Choosing Your Forex Partner

A reliable broker is your gateway to the forex world. They are the custodians of your trades, the facilitators of your strategy. You’ll want a partner who’s regulated, transparent, and fair, one who stands as a beacon of integrity in the often turbulent forex seas. It’s important to know that regulatory bodies like the FCA in the UK, ASIC in Australia, CySec in Cyprus, and others oversee the conduct of brokers within their jurisdictions. These regulatory bodies are the sentinels of the forex market, but they are not the only ones. Many countries have their own regulatory authorities that enforce strict standards to protect traders and ensure fair trading practices.

The Digital Trading Floor

The Forex platform is your digital trading floor. MetaTrader shines as a beacon for many, with tools that illuminate the path ahead. It’s here that you’ll encounter ‘Forex position size calculators’ and ‘Forex Factory’, your compasses in the vast ocean of market data. These tools and services are instruments by which you navigate the currents of currency exchange.

Embracing Technology in Trading

In the realm of forex, ‘Expert Advisors’ and signal services are your first mates, guiding your journey with wisdom gathered from the market’s movements. They whisper advice on when to enter the challenge and when to retreat, ensuring you sail with the winds of data and analysis at your back.

Trading Safely

In forex, the wise sailor knows the value of safety. It’s about understanding the market, using risk management tools, and never venturing more than what the tides of fortune can return. It’s about sailing with a plan, guided by discipline, and the stars of well-researched strategies. Especially for those facing emotional or financial challenges, it’s critical to approach forex with caution. The market is no place for the vulnerable—emotional trading can lead to decisions that capsize your investment. The importance of acquiring the necessary knowledge cannot be overstated, and avoiding the treacherous waters of impulsive trading is a must.

The Art of Analysis

Analysis in forex is an art form, blending technical charts, sentiment, and the latest news into a tapestry that tells the story of the market’s mood. Mastering this art is essential, for it allows you to read the skies and anticipate the market’s next move.

The Dual Faces of Forex

Forex trading is a land of dualities—highly accessible yet complex, liquid yet unpredictable. It offers the allure of profit and the adrenaline of risk. But be wary of the sirens’ call—volatility can be as risky as it is appealing.

Who Treads the Forex Path?

Forex is not a path for the faint-hearted. It calls to the bold, the daring, and the careful. Be mindful of the psychological sirens like greed and the infamous FOMO, which can lead even the most seasoned traders off-course. It’s a journey for those who can balance the scales of risk and reward, recognizing that every treasure comes with its own tale of caution.

Forex Versus the World of Trading

Forex stands unique in the world of trading. Unlike trading CFDs on commodities or indices, forex is a dance of currencies, a game of pairs that respond to global narratives and economic symphonies. Each trader must choose their stage—be it the steady march of gold, the rush of oil, the digital pulse of cryptocurrencies, and the diversity of indices—according to their saga of aspirations and evaluations.