A Closer Look at DOW JONES and the Dow Jones Industrial Average

Welcome to Indices: The Market’s Pulse

Let’s embark on a journey through the dynamic realm of indices trading. Imagine stepping into a world where indices such as the DOW JONES, Nikkei 225, and HSI serve as gateways to understanding the economic vibrancy of places ranging from the USA to Japan and Hong Kong. These indices are much more than mere numbers on a screen; they weave the narratives of powerhouse companies from Apple to HSBC, offering us a glimpse into the pulse of global economies and their shifting trends. As we delve deeper, we’ll focus particularly on the Dow Jones, a cornerstone of market indices that illuminates the economic landscape of nations and sets the stage for our exploration.

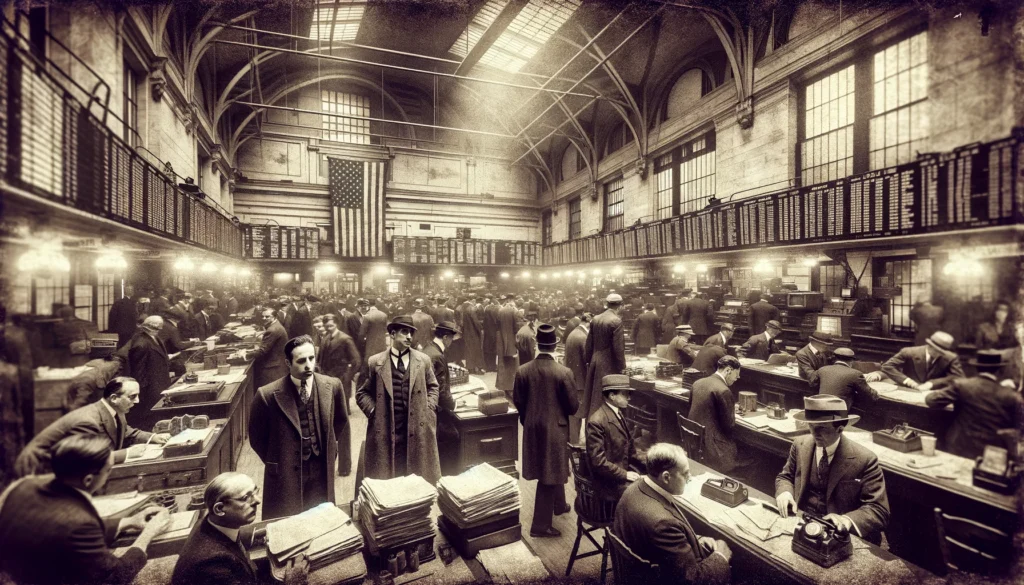

Tracing the Roots of Indices Trading

Did you know that the concept of indices trading dates back to the 1800s? This fascinating journey began with the creation of the Dow Jones Industrial Average DJIA — also known as US30, a name that has since become synonymous with financial markets worldwide. The underlying idea was revolutionary: to distill the market’s broad trends into a single, comprehensible figure, thereby simplifying the investment process for individuals and institutions alike.

The Significance of the Dow Jones

The Dow Jones was not merely a list of stocks; it was a carefully curated representation of the industrial sector’s health, intended to reflect the overall market movement. This innovation provided investors with a clear snapshot of market dynamics, making it easier to gauge economic health at a glance. By aggregating the performances of key companies into a unified index, it introduced a level of transparency and accessibility previously unseen in the financial world.

A Pivotal Moment in Financial History

This development marked a pivotal moment in financial history, transforming how people viewed and engaged with the stock market. The introduction of the Dow Jones Industrial Average paved the way for the creation of numerous other indices, each designed to capture different sectors of the economy or specific market nuances. From the technology-focused NASDAQ Composite to the broad-based S&P 500, indices have become indispensable tools for investors seeking to understand market trends, compare performance, and make informed decisions.

The Legacy of Indices Trading

Index trading changed the game by simplifying financial markets. It opened a new chapter in market analysis, making economic trends easier to grasp for investors. Index prices move with global events, economic shifts, and company news. These factors turn trading into a dynamic journey of risks and rewards for smart traders.

The Index-Economy Connection

Think of an index as a country’s financial heartbeat. A strong and steady index often means the economy is doing well. But if it dips, it might be hinting at some trouble, maybe economic hiccups or political uncertainty.

The Many Paths to Trading Indices

Trading indices offers a tailored journey beyond just buying assets. Alternatives like CFDs, futures, and ETFs open up exciting possibilities. CFDs allow for flexible speculation on price movements without owning the assets. Futures set a clear path for future trades by locking in prices ahead of time. ETFs offer a diverse mix in one package, ideal for broad market exposure. Each method caters to different trading strategies and preferences, enriching the index trading experience.

Your Guide to a Trustworthy Broker

Finding a broker for indices trading is like choosing a travel companion. You want someone reliable, clear about the journey (read: fees and spreads), and regulated by big names like FCA, DFSA, ASIC, or your local regulatory body. Make sure they offer a variety of indices and are ready to support you whenever you need them.

Indices vs. Share CFDs Trading

In indices trading, you’re looking at a group of stocks, which means a more diversified risk and a broader market view. On the flip side, with share CFDs, you zoom in on specific companies. While this offers the potential for higher individual gains, it also brings a focused risk. Indices trading is ideal for those who want a wide market scope, whereas share CFDs appeal to those who prefer in-depth analysis of individual companies.

The Balancing Act of Trading Indices

Indices trading is for those who love a mix of adventure and calculated risks. It’s about finding that sweet spot between risk and reward. But it’s not for the faint-hearted or those in a tough spot emotionally or financially. The world of leveraged products is tricky and not the place for taking undue risks.

Comparing Indices with Other Trading Avenues

Indices offer a diversified investment compared to forex, shares CFDs, commodities CFDs such as gold and oil, and cryptocurrencies. Each asset class carries its risk profile, liquidity level, and market dynamics, making them suitable for different trading strategies and risk appetites.